You ever feel like you are always trying to save but never actually saving? Don’t worry, this used to be me.

Maybe you want to save £5,000 for a rainy day fund. You also don’t want to live like a monk, survive on instant noodles, or say goodbye to every shred of joy in your life. I get it. Good news: you don’t have to.

Using the 50/30/20 budgeting system, I built a £5,000 emergency fund in six months - bear in mind I was earning near minimum wage at this time. And don’t worry, I did it without cutting out coffee, Netflix, or the occasional overpriced brunch.

Why should you care? Because being broke is exhausting. Burdening debt, worrying about emergency expenses, and financial stress are draining. A £5,000 safety net buys you peace of mind, options, and the ability to deal with unexpected expenses easily.

Unfortunately… most people never experience this peace of mind.

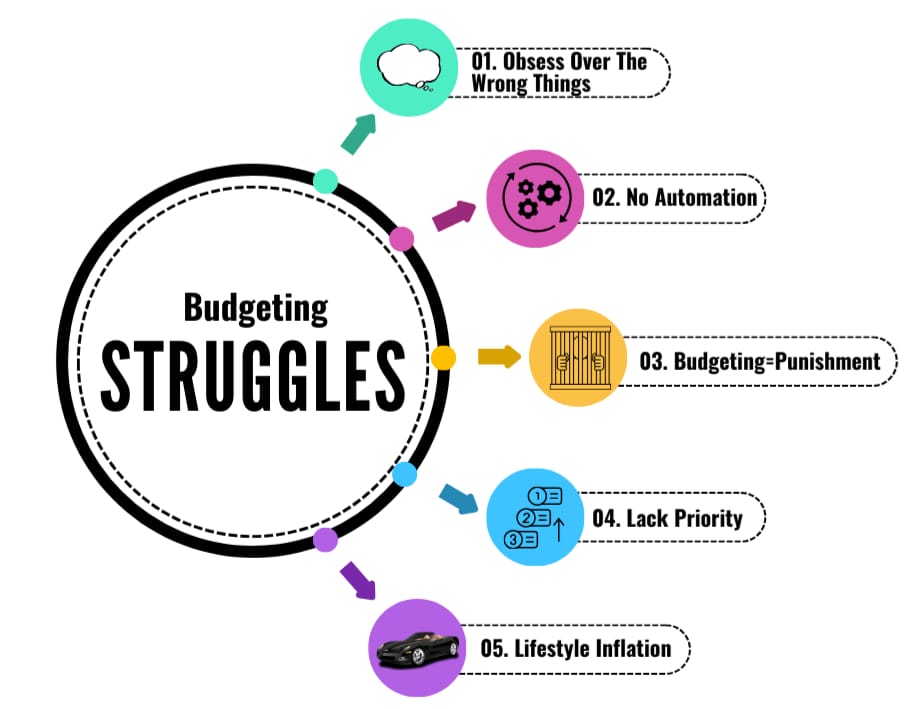

Why Most People Struggle to Save (And Stay Broke Forever)

1. They Obsess Over Pennies Instead of Pounds

Skipping lattes won’t make you rich. Fretting over minor expenses while ignoring the biggies like rent, transport, and debt is like trying to remove water from a sinking ship with a teaspoon. Focus on your biggest expenses first, not the tiny ones…(yes, those tiny expenses like coffee that actually bring some joy into your life).

2. They Don’t Automate Their Savings

If you rely on willpower to save, you’ve already lost. Your brain is hardwired to spend what it sees in your account. Set up automatic transfers before you touch your paycheck - otherwise, that money is as good as gone. I know you’re nodding in agreement right now.

3. They Confuse "Budgeting" With "Punishment"

Most people think budgeting = financial prison. Nope. Good budgeting lets you spend on things you actually enjoy - guilt-free. Life is to be lived don’t forget. What’s the trick? Allocating money intentionally, not impulsively.

4. They Try to Save After Spending

“I’ll just save whatever’s left at the end of the month.” Spoiler: There’s never anything left. Pay yourself first, and then spend the rest. Your future self will thank you.

As the Oracle of Omaha, Warren Buffett, once said, “Do not save what is left after spending; instead spend what is left after saving.”

5. They Increase Spending Every Time They Make More

The moment they get a raise, they upgrade their lifestyle instead of increasing savings. This is known as lifestyle inflation, and it’s why people earning six figures can still be broke.

But don’t worry - after reading this you’re not going to make these mistakes. Here’s how you do it right.

Here’s the System That Actually Works: The 50/30/20 System (I Swear By It)

Step 1: Pay Yourself First (The 20%)

This is the non-negotiable part. Emphasis on non-negotiable. Before you spend a single penny, 20% of your income goes straight to savings. Treat it like rent - you wouldn’t skip rent, would you?

💡Example: If you make £2,500 a month, £500 goes straight into savings. Automate this so you don’t “accidentally” spend it. (Yes, you. You will spend it.)

Bonus Tip: Open a separate bank account for savings. There are some great high-interest savings accounts available at the moment, e.g. Trading212 is offering interest of 4.9% on Cash ISAs.

Check out more great offers here.

Step 2: Cover Your Needs (The 50%)

Half your income should cover the boring but necessary stuff - rent, bills, groceries, transport, minimum debt payments.

💡If your essentials use up more than 50%? You either:

✅Find ways to cut costs (move, negotiate bills, get a roommate)

✅Boost your income (ask for a raise, get a side job)

✅Be flexible. Accept that your percentages will shift - but don’t touch the 20% savings

Step 3: Spend Guilt-Free on Wants (The 30%)

Here’s where most people mess up. You are allowed to spend money on fun. But there is a catch. You need to put in place a hard limit.

💡This includes:

✔️Eating out, subscriptions, gym, shopping, hobbies, weekend trips, entertainment, dating…and whatever else you want to do.

You get 30% guilt-free. The moment you pass that limit? Stop.

How to Actually Implement the 50/30/20 Rule (Without Losing Your Mind)

Knowing the rule is great. Actually using it? That’s where most people fail. So here’s exactly how to set up this system step by step.

Step 1: Figure Out Your Numbers (Know Where Your Money Is Going)

Before you can implement a budget, you need to know your spending.

✅ Look at your last 3 months of spending.

✅ Sort everything into three categories: Needs (50%), Wants (30%), Savings (20%).

✅ Prepare for a reality check. If your “wants” are secretly eating into your savings, congratulations, you’ve identified the problem.

💡 Example:

If you earn £2,500/month, your ideal budget looks like this:

✔ £1,250 on Needs (50%) → Rent, bills, food, transport

✔ £750 on Wants (30%) → Eating out, Netflix, gym, fun stuff

✔ £500 on Savings (20%) → Emergency fund, investments, debt payoff

🚨 Red Flag: If your rent alone is £1,500, the system will need to be adjusted. (More on that in a second.)

Step 2: Cut Out the Dead Weight (Trim the Fat, Not the Fun)

This is NOT about giving up coffee and other sources of joy - it’s about optimising where your money goes.

🔹 Cancel or downgrade unused subscriptions (Do you really need Netflix, Disney+, AND Prime?)

🔹 Negotiate bills & expenses (Call your provider and ask for a lower rate - this works more often than you think.)

🔹 Rethink ‘Essentials’ (A £60 gym membership might be a luxury if you’re struggling to save.)

🔹 Cook more meals at home (The easiest £100+ per month saved without suffering.)

💡Example: If you cut £200 of excessive spending per month, that’s an extra £2,400 per year - without major sacrifices.

Step 3: Automate Everything (Because Relying On Willpower Is Easier Said Than Done)

If you don’t automate your savings, you will more than likely spend that money.

Period.

✅Set up an auto-transfer for savings (20%) the day you get paid.

✅Use a separate savings account (ideally one that makes withdrawing annoying).

✅Have your bills auto-paid so you don’t “accidentally” spend rent money on ASOS.

💡The Hack: If your savings aren’t in your main account, you won’t feel tempted to dip into them. Out of sight, out of mind - until you need them of course.

Step 4: Adjust the Percentages (If Needed, But Try Keep the 20%)

The 50/30/20 split isn’t set in stone - it’s flexible - but that 20% savings should be non-negotiable.

❌Bad idea: “I can’t save 20% this month, I’ll start next month.” (You won’t.)

✅Better idea: Adjust your needs/wants, but avoid touching that 20%.

💡If your rent is too high and takes 60% of your income, try:

✔60/20/20 (Needs/Wants/Savings)

✔55/25/20 if you can cut some luxuries

✔House-hacking (renting a room, moving, negotiating lower rent)

📌The Goal: Start with whatever you can, but make savings a habit. That’s the goal.

Step 5: Track Progress & Reward Yourself (So You Stick With It)

Saving is boring if you don’t make it fun.

✅Set milestones. Every £1,000 saved? Celebrate (within budget, of course).

✅Use a tracker. Whether it’s a spreadsheet, an app, or writing it on your fridge - seeing progress keeps you going.

✅Remind yourself why. You’re not saving just for fun - you’re building financial security, freedom, and peace of mind.

💡Example: If you save £500/month, you’ll have £5,000 in 10 months. That’s enough to handle most emergencies without stress.

Some budgeting apps I’d recommend:

Plum

Emma

Snoop

Final Thought: Start Today, Not "Someday"

I can guarantee that this system will work if you do it. The hardest part? Starting.

Set up your automatic transfer today so that every payday funds are automatically transferred into savings.

Use the 50/30/20 system as a template, but you can always be flexible. Find what works for you.

And in six months, when you have a fat savings cushion and zero financial stress? You’ll be really glad you did.

🔥 Want more smart money strategies? Hit reply and tell me your biggest saving struggle - I’ll try cover it in a future issue.